Electronic payment, or e-payment, has experienced significant growth and adoption in China, revolutionising the way people make transactions. E-payment has transformed the way payments are conducted in China, making it convenient, efficient, and secure.

Electronic payment, or e-payment, has experienced significant growth and adoption in China, revolutionising the way people make transactions. E-payment has transformed the way payments are conducted in China, making it convenient, efficient, and secure.

The dominance of mobile payment apps, such as Alipay and WeChat Pay, has led to a cashless revolution and expanded financial inclusion, propelling China to the forefront of the e-payment landscape. Here's an introduction to e-payment in China:

Moving towards a cashless society

China’s digital payments and retail revolution was facilitated by two crucial factors.

Firstly, the high levels of bank account ownership laid a solid foundation for the adoption of mobile wallets. Third-party payment companies such as Alipay and WeChat Pay leveraged the existing financial infrastructure, including bank accounts, bank cards, and clearing and settlement systems to facilitate transactions.

Secondly, the widespread ownership of smartphones played a pivotal role. The combination of smartphones and bank accounts allowed users to easily link their accounts to mobile applications, providing a seamless experience for digital payments.

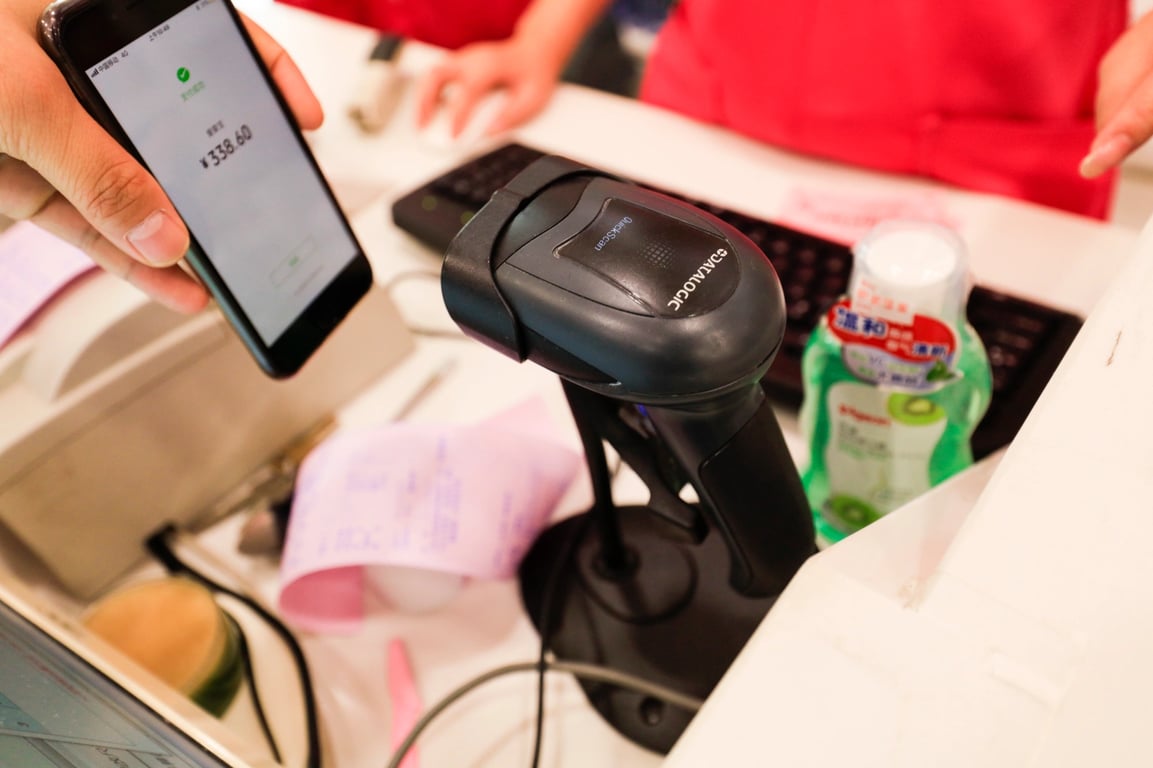

The combination of the two factors and the ubiquity of QR code payments have played a significant role in China's cashless transformation. Merchants display QR codes, which users can scan with their mobile devices to make payments. This payment method has low transaction costs, making it attractive for both businesses and consumers.

In another effort to actively support the transition to a cashless society, the Chinese government has also promoted the use of digital yuan, also known as e-CNY, in recent years. Civil servants, schoolteachers, medical staff, technicians, journalists for official media outlets, and state enterprise employees are expected to receive their salaries in e-CNY from May 2023. (Tan, 2023)

As China transitions to a cashless society, data security and privacy concerns have emerged. In 2021, China enforced 2 new laws that deal with data privacy and security.

The Data Security Law (DSL 数据安全法) is a framework that categorises user data collection and storage in China based on its potential security and economic impact on the country.

The Personal Information Protection Law (PIPL 个人信息保护法) regulates the collection and protection of personal information obtained by organisations operating in China.

These laws have been implemented to impact companies in China that utilise user data, ensuring they comply with how they handle, store, use, and transfer the personal information they collect (China Data Privacy Laws: How They Affect Foreign Companies - Moore, 2022).

Integration of Digital Payments

Apart from mobile payment platforms and QR code payments, e-payment services are deeply integrated into various aspects of daily life in China.

Apart from mobile payment platforms and QR code payments, e-payment services are deeply integrated into various aspects of daily life in China.

E-payment methods are widely accepted across various sectors in China, including retail stores, restaurants, transportation, online shopping, and even street vendors.

It is common for individuals and businesses of all sizes to accept e-payments, even in remote areas. Thus users can pay for groceries, dining, shopping, utility bills, transportation, movie tickets, and more using mobile payment apps. E-payment is also widely used for peer-to-peer transfers, splitting bills, and charitable donations.

E-payment platforms in China have expanded beyond just payment services. They offer a range of online-to-offline (O2O) services, such as ordering food delivery, booking tickets, hailing rides, and accessing financial products like loans and investments.

Two main modes of digital payments in China: Alipay & WeChat Pay

Alipay and WeChat Pay are two prominent mobile payment platforms in China that have transformed the way people make transactions.

Alipay, also known as 支付宝, is operated by Ant Group, an affiliate of Alibaba Group. Alipay allows users to link their bank accounts or add funds to their Alipay digital wallets. Users can make payments by scanning QR codes displayed by merchants or through in-app payment options.

Alipay offers a wide range of services beyond payments, including money transfers, bill payments, online shopping, investment options, and even credit services. It also provides features like wealth management tools, credit scoring, and insurance services. It also provides features like wealth management tools, credit scoring, and insurance services.

WeChat Pay, also known as 微信支付, is operated by Tencent Holdings, and was launched in 2013 and quickly gained traction due to the extensive user base of WeChat.

WeChat Pay allows users to link their bank accounts or add funds to their WeChat Pay digital wallets. Moreover, WeChat Pay offers a wide range of services, including person-to-person transfers, in-store and online payments, utility bill payments, transportation ticketing, and more. WeChat Pay is also deeply integrated within the WeChat app, allowing users to access various services without leaving the platform.

Trends, Challenges, and Opportunities in the Digital Payments Market

The e-payments market in China is constantly evolving, with new trends and challenges emerging. One emerging trend is the use of facial recognition technology to make payments, which is becoming more popular in China. However, e-payment providers and users also face several challenges, including security concerns and regulatory issues. For example, the Chinese government has recently cracked down on e-payment providers, imposing stricter regulations on the industry.

Despite these challenges, the e-payments market in China presents several opportunities for growth and innovation. For example, e-payment providers can expand their services to include more financial products like loans and insurance. Additionally, e-payment providers can partner with other companies to offer more integrated services like travel and entertainment.

Conclusion

In conclusion, the e-payments market in China is dominated by Alipay and WeChat Pay, two mobile payment platforms that have transformed the way people pay for goods and services. Mobile payments in China are more advanced and sophisticated than in the West, and the market presents several opportunities for growth and innovation. However, e-payment providers and users also face several challenges, including security concerns and regulatory issues. Businesses and consumers must understand the e-payments market in China to take advantage of its benefits and navigate its challenges. The future outlook for e-payments in China is bright, with continued growth and innovation expected in the years to come.